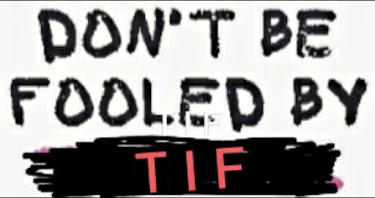

Tax Incremental Financing (TIF) is part of the new mall-project's funding source for "reclaiming" the streets lost to downtown Burlington during Urban Renewal. Burlington voters will be asked to vote on using $22 million in TIF funds to finance the rebuilding of streets that will serve to improve Don Sinex's development project and increase his income. Because of the way TIF works, a large proportion of tax revenue generated by a new project (in this case 75%) has to go to paying back the TIF loan over a period of 20 or 30 years, leaving only 25% to pay for expensive infrastructure costs (which may not be enough for a project of this scale). But what is TIF and why do some people see it as free money while others see it as a dangerous gamble (it has been outlawed in California!)? The following is excerpted from an article called "Tax Incremental Financing: A Bad Bargain for Tax Payers," by Daniel McGraw, published on a site called Reclaim Democracy: Restoring Citizen Authority Over Corporations:

TIFs have been around for more than 50 years, but only recently have

they assumed such importance. At a time when local governments’ efforts

to foster development, from direct subsidies to the use of eminent

domain to seize property for private development, are already out of

control, TIFs only add to the problem: Although politicians portray TIFs

as a great way to boost the local economy, there are hidden costs they

don’t want taxpayers to know about. Cities generally assume they are not

really giving anything up because the forgone tax revenue would not

have been available in the absence of the development generated by the

TIF. That assumption is often wrong.

“There is always this expectation with TIFs that the economic growth

is a way to create jobs and grow the economy, but then push the costs

across the public spectrum,” says Greg LeRoy, author of The Great American Jobs Scam: Corporate Tax Dodging and the Myth of Job Creation.

“But what is missing here is that the cost of developing private

business has some public costs. Road and sewers and schools are public

costs that come from growth.” Unless spending is cut—and if a TIF really

does generate economic growth, spending is likely to rise, as the local

population grows—the burden of paying for these services will be

shifted to other taxpayers. Adding insult to injury, those taxpayers may

include small businesses facing competition from well-connected chains

that enjoy TIF-related tax breaks. In effect, a TIF subsidizes big

businesses at the expense of less politically influential competitors

and ordinary citizens.

“The original concept of TIFs was to help blighted areas come out of

the doldrums and get some economic development they wouldn’t [otherwise]

have a chance of getting,” says former Fort Worth City Councilman Clyde

Picht, who voted against the Cabela’s TIF. “Everyone probably gets a

big laugh out of their claim that they will draw more tourists than the

Alamo. But what is worse, and not talked about too much, is the shift of

taxes being paid from wealthy corporations to small businesses and

regular people.

“If you own a mom-and-pop store that sells fishing rods and hunting

gear in Fort Worth, you’re still paying all your taxes, and the city is

giving tax breaks to Cabela’s that could put you out of business,” Picht

explains. “The rest of us pay taxes for normal services like public

safety, building inspections, and street maintenance, and those services

come out of the general fund. And as the cost of services goes up, and

the money from the general fund is given to these businesses through a

TIF, the tax burden gets shifted to the regular slobs who don’t have the

same political clout. It’s a crummy way to treat your taxpaying,

law-abiding citizens.”

Almost every state has a TIF law, and the details vary from

jurisdiction to jurisdiction. But most TIFs share the same general

characteristics. After a local government has designated a TIF district,

property taxes (and sometimes sales taxes) from the area are divided

into two streams. The first tax stream is based on the original assessed

value of the property before any redevelopment; the city, county,

school district, or other taxing body still gets that money. The second

stream is the additional tax money generated after development takes

place and the property values are higher. Typically that revenue is used

to pay off municipal bonds that raise money for infrastructure

improvements in the TIF district, for land acquisition through eminent

domain, or for direct payments to a private developer for site

preparation and construction. The length of time the taxes are diverted

to pay for the bonds can be anywhere from seven to 30 years.

Local governments sell the TIF concept to the public by claiming they

are using funds that would not have been generated without the TIF

district. If the land was valued at $10 million before TIF-associated

development and is worth $50 million afterward, the argument goes, the

$40 million increase in tax value can be used to retire the bonds. Local

governments also like to point out that the TIF district may increase

nearby economic activity, which will be taxed at full value.

So, in the case of Cabela’s in Fort Worth, the TIF district was

created to build roads and sewers and water systems, to move streams and

a lake to make the property habitable, and to help defray construction

costs for the company. Cabela’s likes this deal because the money comes

upfront, without any interest. Their taxes are frozen, and the bonds are

paid off by what would have gone into city coffers. In effect, the city

is trading future tax income for a present benefit.

But even if the dedicated tax money from a TIF district suffices to

pay off the bonds, that doesn’t mean the arrangement is cost-free. “TIFs

are being pushed out there right now based upon the ‘but for’ test,”

says Greg LeRoy. “What cities are saying is that no development would

take place but for the TIF.…The average public official says this is

free money, because it wouldn’t happen otherwise. But when you see how

it plays out, the whole premise of TIFs begins to crumble.” Rather than

spurring development, LeRoy argues, TIFs “move some economic development

from one part of a city to another.”

Development Would Have Occurred Anyway

Local officials usually do not consider how much growth might

occur without a TIF. In 2002 the Neighborhood Capital Budget Group

(NCBG), a coalition of 200 Chicago organizations that studies local

public investment, looked at 36 of the city’s TIF districts and found

that property values were rising in all of them during the five years

before they were designated as TIFs. The NCBG projected that the city of

Chicago would capture $1.6 billion in second-stream property tax

revenue—used to pay off the bonds that subsidized private

businesses—over the 23-year life spans of these TIF districts. But it

also found that $1.3 billion of that revenue would have been raised

anyway, assuming the areas continued growing at their pre-TIF rates.

The experience in Chicago is important. The city invested $1.6

billion in TIFs, even though $1.3 billion in economic development would

have occurred anyway. So the bottom line is that the city invested $1.6

billion for $300 million in revenue growth.

The upshot is that TIFs are diverting tax money that otherwise would

have been used for government services. The NCBG study found, for

instance, that the 36 TIF districts would cost Chicago public schools

$632 million (based on development that would have occurred anyway) in

property tax revenue, because the property tax rates are frozen for

schools as well. This doesn’t merely mean that the schools get more

money. If the economic growth occurs with TIFs, that attracts people to

the area and thereby raises enrollments. In that case, the cost of

teaching the new students will be borne by property owners outside the

TIF districts.

Such concerns have had little impact so far, in part because almost

no one has examined how TIFs succeed or fail over the long term. Local

politicians are touting TIFs as a way to promote development, promising

no new taxes, and then setting them up without looking at potential side

effects. It’s hard to discern exactly how many TIFs operate in this

country, since not every state requires their registration. But the

number has expanded exponentially, especially over the past decade.

Illinois, which had one TIF district in 1970, now has 874 (including one

in the town of Wilmington, population 129). A moderate-sized city like

Janesville, Wisconsin—a town of 60,000 about an hour from Madison—has

accumulated 26 TIFs. Delaware and Arizona are the only states without

TIF laws, and most observers expect they will get on board soon.

First used in California in the 1950s, TIFs were supposed to be

another tool, like tax abatement and enterprise zones, that could be

used to promote urban renewal. But cities found they were not very

effective at drawing development into depressed areas. “They had this

tool, but didn’t know what the tool was good for,” says Art Lyons, an

analyst for the Chicago-based Center for Economic Policy Analysis, an

economic think tank that works with community groups. The cities

realized, Lyons theorizes, that if they wanted to use TIFs more, they

had to get out of depressed neighborhoods and into areas with higher

property values, which generate more tax revenue to pay off development

bonds.

The Entire Western World Could Be Blighted

Until the 1990s, most states reserved TIFs for areas that could

be described as “blighted,” based on criteria set forth by statute. But

as with eminent domain, the definition of blight for TIF purposes has

been dramatically expanded. In 1999, for example, Baraboo, Wisconsin,

created a TIF for an industrial park and a Wal-Mart supercenter that

were built on farmland; the blight label was based on a single house in

the district that was uninhabited. In recent years 16 states have

relaxed their TIF criteria to cover affluent areas, “conservation areas”

where blight might occur someday, or “economic development areas,”

loosely defined as commercial or industrial properties.

The result is that a TIF can be put almost anywhere these days. Based

on current criteria, says Jake Haulk, director of the Pittsburgh-based

Allegheny Institute for Public Policy, you could “declare the entire

Western world blighted.”

The rest of the article can be read here: http://reclaimdemocracy.org/tax_increment_financing/

Updates on plans for development of The Pit. Residents are asking Don Sinex to hold genuine public engagement listening sessions at our Neighborhood Planning Assemblies (NPAs) to hear what we want our city to look like, feel like, be like. We want a new green deal from whoever invests in developing The Pit. We want union labor, livable wages that will be a geyser of prosperity for downtown businesses and the tax collector. We can do this together, the Burlington way.

Subscribe to:

Comments (Atom)

TIF Is a Subsidy to CityPalace Investors

The state's explanation of TIF says: "Current statute requires that the municipality pledge at least 85% of the incremental munic...

-

Mayor Weinberger's vision of Burlington garnered a minority vote from residents in the recent election. 129 votes short of electing a ...

-

This video was shot by our friend, Jay Vos, at the City Council meeting on Thursday. Please join us on Monday and Wednesday at 5 for th...

-

2/23/2021 Special City Council Meeting Item 3.01 Resolution : “Authorization To Resolve Litigation And Execute Amended And Restated Devel...

No comments:

Post a Comment