Tony Redington has conducted a survey and analysis of the number and kind of living spaces available in Burlington right now, considering the 1400 new units under construction, and discovered two things:

1. Despite what advocates of unconscionable development continue to repeat: the vacancy rate is rising and rising. It is not 1%, as the city has been saying for so long; it is actually rapidly moving toward 3%

2. Unless we raise the minimum wage ($15, $20?), working people will not be able to afford the housing that is available. The vacancy rate will likely rise even further the more units are built, and the housing crisis, which is really an affordability crisis, not a housing crisis, will not be addressed at all.

Here is Tony's report:

7/15/2016

Ample Rental Housing Availability in Burlington Today

...rental vacancy rate possible upward rise to “glut” status?

With a first hand experience of searching for an apartment just five years ago in Burlington

when there were practically none, a snapshot of available apartments today—129 tabulated—

shows a surprising number of apartments in most neighborhoods which confirms two recent

studies showing a 2.5% vacancy rate moving to a “healthy” 3-5% vacancy range for

Burlington and Chittenden County.

There is a myth about a current housing crisis because of no housing available to rent--we

just need to build more units and that will alleviate half the crisis (the other half being

households being able to afford rentals). Well, the lack of housing units available is just that,

a myth, and the 1,400 units built, under construction and well into the permitting process 2014

to date in Burlington alone suggests there more likely exists an increasingly healthy vacancy

rate and a possible oncoming housing glut. A a return to the drought of years past—just ask

landlords and they express concerns over lack of rental demand in this market when they

know projects are rapidly coming on line. Even with the current level of vacancy rental costs

very likely will not rise and in fact decline modestly in the coming months.

A survey of apartments for rent through newspaper and online sites like Craigslist is a quick

and easy way to gauge housing availability and median prices in a small housing market like

that of Burlington. The last census counted about 10,000 rental units and the 129 units

tabulated here represent 1.3% of the 2010 inventory. Here are the results as found without

adjusting for costs of utilities (most do not include electric or heat). The July 11-12 survey is

not exhaustive but the numbers do reflect what a person seeking a rental would likely find at

this time.

Survey of 129 Apartments for Rent Listings Online July 11-12, 2016

Bedroom Size Number Price Range Median (Middle) Price

0 (studio) 14 $700-$1,400 $968

1 38 $700-$1,900 $1,050

2 43 $700-$2,600 $1,050

3 26 $799-$2595 $1,825

4 or more 8 $875-$2,900 $2,400

Note Bright Street Coop and 237 Pearl Street were clearly in process of renting up their

respective projects.

Clearly the 129 units are an “indicator” as apartment brokers generally have many units that

are not placed onto online availability. The two most recent authoritative private surveys over

the past year revealed about a 2.5% average vacancy rate for Burlngton and the Chittenden

County with an upward trend.

Housing Affordability and the $15 Minimum Wage

The impact of minimum wage changes on apartment affordability are quite dramatic. A

minimum wage worker income ($9.20 minimum wage in Vermont today) is approximately

$20,000 a year, so a median rent efficiency (studio) apartment would consume about 60% of

income. For a couple earning minimum wage, a one bedroom median rent apartment would

consume about 32% of total income. With a minimum wage of $15 the percentages drop to

37% for a single person renting a median priced studio apartment devoted to rent working at minimum wage, and 20% for two minimum wage workers for a median priced one-bedroom

rental.

There are other important factors favoring an increased vacancy rate and some rent

reductions from resultant market forces. These include not only additions to the rental

inventory—about 900 units from the Ireland Grove Street and Cambrian Rise (Burlington

College lane project) but also from the drop of as many as 1,000 students in rental housing

since the peak year of 2010, and a slight decline in under 65-age population for the current

2010-2030 projection period for the County as a whole.

Two major housing needs? First, deep subsidy rental “voucher” type assistance which

enables renter choice—the federal government has cut these by about 1,000 units since

2000. Perhaps the State and even the City might move to fill this gap. Second, there

remains and will continue a major need for senior housing and a continuum of senior housing

ranging from apartments, assisted housing, group homes and finally nursing homes of various care levels.

Apartments available websites

Here are three popular websites to find rental housing in Burlington and Chittenden County:

Burlington housing market rental websites:

Craigslist: https://vermont.craigslist.org/search/apa?postal=05401

Apartments.com:

http://www.apartments.com/apartments/burlington-vt/?

Bissonnette Properties:

http://bissonetteproperties.com/august-rentals/

Tony Redington

TonyRVT99@gmail.com

July 15, 2016

Updates on plans for development of The Pit. Residents are asking Don Sinex to hold genuine public engagement listening sessions at our Neighborhood Planning Assemblies (NPAs) to hear what we want our city to look like, feel like, be like. We want a new green deal from whoever invests in developing The Pit. We want union labor, livable wages that will be a geyser of prosperity for downtown businesses and the tax collector. We can do this together, the Burlington way.

Subscribe to:

Post Comments (Atom)

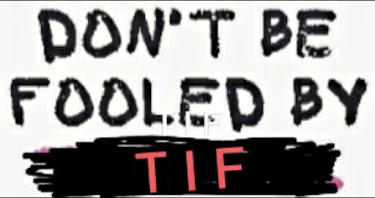

TIF Is a Subsidy to CityPalace Investors

The state's explanation of TIF says: "Current statute requires that the municipality pledge at least 85% of the incremental munic...

-

Mayor Weinberger's vision of Burlington garnered a minority vote from residents in the recent election. 129 votes short of electing a ...

-

This video was shot by our friend, Jay Vos, at the City Council meeting on Thursday. Please join us on Monday and Wednesday at 5 for th...

-

2/23/2021 Special City Council Meeting Item 3.01 Resolution : “Authorization To Resolve Litigation And Execute Amended And Restated Devel...

No comments:

Post a Comment