2/23/2021 Special City Council Meeting Item 3.01

Resolution: “Authorization To Resolve Litigation And Execute Amended And Restated Development Agreement With BTC Mall Associates” (sponsored by Councilors Paul, Paulino, Mason, Shannon and Carpenter).

Burlington is more than ready to see something happen with the excavated pit in the center of downtown. Concerns are not about the new building designs as these can be addressed during the Development Review Board process.

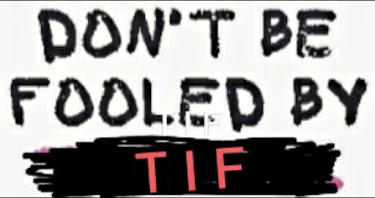

Concern is that the terms contained in these documents are not in the best interests of the City and will cause the City to repeat its three prior failures. Past City Councils were induced to sign similarly immature and obfuscated development agreements. The predictable bad outcome has been exacerbated by the City's lax TIF accounting procedures . That’s why we have nothing but a pit today.

First reason to vote “No”:

There is no looming deadline in the Chittenden Superior Court case that forces a rushed decision on these documents. City Council must take the necessary time to understand them.

Second reason to vote “No”:

The City must first resolve the problems with the City’s accounting procedures for TIF-funded projects. Ten years of Auditors' warnings about the City's accounting problems asnoted in the annual Management Letters must end.

Third reason to vote “No”:

The history of three prior failed Development Agreements with BTC Mall Associates should have taught us a lesson . The City must take care to avoid following the same pathway to failure

Fourth reason to vote “No”

The disorganized and confusingly identified documents provided to City Council for this consequential decision has resulted in obfuscation of the contract terms being approved.

Fifth reason to vote “No”:

The Litigation Resolution Agreement includes an overly broad Mutual Release of liability for all claims against BTC Mall Associates that might exist under any of the prior failed agreements, and which might be discovered after the new versions of the development documents are approved.

Details as follows...---->

First reason to vote “No”:

There is no looming deadline in the Chittenden Superior Court case that forces a rushed decision on these documents. City Council must take the necessary time to understand them. At the last City Council meeting on Feb. 16, Mayor Weinberger said:

"This is a matter of active litigation," Weinberger said. "We have essentially the court on hold. We have invested tens of thousands of dollars to get to this point. We need to make a decision as to whether we are going to continue with that litigation, or we are going to take this other alternative, the settlement."

The truth is, there are no scheduled hearings or other deadlines looming at the Chittenden Superior Court that would force City Council to sign up for the new CityPlace deal in a rush. The City’s finances and clarity on the important terms contained in the agreements must be sorted out first. The only consequence of a no vote would be the Court’s scheduling of a status conference or hearing on the City’s case and BTC Mall Associates Counterclaim.

The mediation between the parties had concluded in mid-December and the “confidential MOU” was signed in December ,so it’s not clear why this was not announced by the Mayor until the beginning of February. Most of the action in the Superior Court case so far has been regarding BTC Mall’s the third-party claim against PC Construction which sought to delay the two arbitration proceedings in process between those two parties. The Judge told BTC Mall Associates the proper forum for their complaints was in the arbitration proceedings, not the Superior Court case.

Second reason to vote “No”:

The City must first resolve the problems with the City’s accounting procedures for TIF-funded projects. Ten years of Auditors' warnings about the City's accounting problems as noted in the annual Management Letters must end. Annual City Audits over the last ten years have revealed problems with the City’s accounting procedures when managing capital projects like CityPlace, where TIF-funding is involved. See my communication of 2/16/2021 City Council Meeting at Consent Agenda item 5.18 with extracts from ten years of critical Management Letters: http://go.boarddocs.com/vt/burlingtonvt/Board.nsf/goto?open&id=BYAN6V5E5667

The proposed CityPlace “Amended and Restated Development Agreement” (abbreviated various places as the“A&R DA”) between Burlington and BTC Mall Associates contains the proposal for $10 M of TIF borrowing with $7.7 M going to BTC Mall Associates to reimburse for reconstruction of Pine and St. Paul St. segments extending through the proposed development. The proposed $10M TIF debt load, called the “Estimated TIF Funding Amount” is explained at item 4(c)(I) on page 26. This TIF borrowing must be completed by June 30, 2022, Vermont’s new extended deadline for Burlington due to the coronavirus situation.

Note that in that paragraph the City also states in item 4(c)(I) on page 26 :

“The City makes no representation whatsoever about the actual amount of TIF debt the Revised Project will actually support.”

The City proposes to recalculate its TIF debt numbers as the project evolves, to derive an alternate debt load amount called the “Available TIF Amount” that supposedly could be covered by tax revenues due to the value of the” Private Improvements” consisting of the three towers: Northwest, Northeast and South. This allows everything to run loose and is financially risky. That’s why we’re where we are today. The three prior versions were also managed in a financially undisciplined manner.

We know there is language in the Agreements that BTC Mall Associates must start and complete the three towers of the project by certain dates. They could lose the right to reimbursement of their costs to build the Pine and St. Paul street segments if they miss target dates. However, the time line about the “Revised Project” can be changed by the City as we have seen happen with the three prior versions of the agreements. The City wants to be able to make adjustments to their TIF borrowing plans on the fly:

“As the Revised Project progresses through design development, the City will update and finalize its determination of the amount of TIF debt that the Revised Project would support (the City’s final determination of such being referred to herein as the “Available TIF Amount”). Until the City has made a final determination of the Available TIF Amount, the parties shall use the Estimated TIF Funding Amount for planning purposes as a placeholder for the Available TIF Amount. The City shall determine both the aggregate Available TIF Amount that would be supported by the Revised Project, as well as the respective amounts that each Phase of the Revised Project would support, all based on the Revised Project Schedule and the parameters for the Waterfront TIF District.“

If only $10M of debt from originally requested $21.8 M TIF debt is issued initially, the A&R DA includes a proposal to ask the legislature in 2022 for more time to do additional TIF borrowing for the project:

“Legislative Matters. To the extent that the City has successfully issued TIF debt for the Revised Project, but issued such TIF debt for less than the Available TIF Amount, the Parties shall reasonably cooperate in good faith to support legislative changes in the 2022 (and subsequent, if applicable) legislative session(s) to facilitate the issuance of additional rounds of TIF financing as may be supported by later Phases of the Revised Project. “

This is all very loose. Too loose for a big ticket capital project like this. Are the proposed project schedules really something that will be followed? What makes us confident they will be? We are where we are today because schedules slipped under the prior three versions of the agreements, until they slipped off the cliff.

The 2017 Development Agreement includes specific TIF Administration procedures for monitoring BTC Mall Associates’ accumulating reimbursable TIF-eligible expenditures. Yet in the document currently before City Council as part of the document package, with the filename: “EA - O - Preliminary Budget 020821 - Final.pdf” the TIF-reimbursable expenses for BTC Mall Associates expenses prior to 9/5/2020 are listed as “to be determined," while the projected TIF-Funded after 9/5/2020 are projected to be $7.7 million.

Why does the City not know or if it does know, is not informing City Council of the magnitude TIF-reimbursable expenses BTC Mall Associates can claim in addition to the $7.7 million more projected for the future? Why has Brookfield Asset Management, a former partner in the CityPlace project, claimed $70 million has been spent so far on the project but the City’s capital project accounting procedures cannot account for where it might have been spent?

The 2021 proposed Amended and Revised Development agreement contains a reference to a missing Exhibit D, the “Advanced Preliminary Budget.” In its place is the notation:

“[to be attached upon Release from Escrow]”

It can be discovered, that a separate document exists among those provided to City Council, with a file name, “ EA - O - Preliminary Budget 020821 - Final.pdf” contains: “Exhibit O - to Escrow Agreement - Preliminary Budget, Owner’s Anticipated TIF Eligible Costs for PI” (Public Improvements). This appears to be a variant of the missing Exhibit D.

Exhibit O lists the $7. 7 M of expenses proposed to be reimbursed under the new deal to BTC Mall Associates for constructing the Pine and St. Paul Street segments, for work to be done after Sept. 5, 2020. This is the day after BTC Mall Associates notified the City they were terminating the original Development Agreement. Notably absent are the expenses for BTC’s “Documented Public Improvement Costs Incurred prior to 9/5/2020." Those items are listed as “TBD” or to-be-determined. The ** notation for the column of “TBD” values headed by “Documented Public Improvement Costs incurred prior to 9/5/20 BTC (**)” states:**All values subject to documentation and accounting as TIF Eligible Costs in accordance with the A&R DA.

This Exhibit O does not reflect TIF Eligible Costs (I) paid by BTC prior to September 5, 2020, or (ii) paid or to be paid by the City, each in accordance with the A&R DA, and the values identified as “TBD” will be documented and accounted for as this preliminary budget is advanced through the processes set forth in this Escrow Agreement and in the A&R DA. For clarity, the City’s Tier # 1 limit of $500,000 for PI costs is inclusive of any TIF reserves the City may establish prior to Tier # 2.

The expenses already incurred by BTC in the past, before Sept. 5, 2020, for TIF-reimbursable expenditures can not possibly be “TBD.” to-be-determined. The 2017 Development Agreement provided for specific TIF Administration procedures which should have kept the City informed month by month, quarterly and annually, as any TIF- reimbursable expense were incurred by BTC Mall Associates.

On Sept. 8, 2020, the City filed a suit against BTC Mall Associates in Chittenden Superior Court. They claimed BTC had breached the 2017 Development Agreement by failing to reconstruct the Pine and St. Paul street segments. They ask the court to force BTC Mall Associates to build the street segments at their own cost.

In the City’s Motion for Preliminary Injunction and Order of Specific Performance, they imply that they have not received the required quarterly and annual TIF-reimbursable accountings from BTC Mall Associates as required by the Development Agreement that would allow them to believe the claimed $70M in expenditures so far. It states on page 6:

“ On August 18, 2020, Brookfield (the successor-in-interest to Rouse Properties – the entity obligated to fund equity for the Project construction to $56 million) told the City in writing that it had invested $70 million in the Project....Nonetheless, the only construction performed on the Project was the initial structural demolition. Accordingly, significant funds should remain in BTC to immediately complete construction of the Public Improvements and Additional Public Improvements without the need for financing.”

The City’s Motion goes on to state at page 15,

“While the City has not been given an accounting of this investment (as it has requested),it strains credulity that this $70 million investment has been depleted to such an extent that sufficient equity financing no longer exists to fund construction of the Public Improvements and Additional Public Improvements as required under the Development Agreement.”

Whichever of BTC’s expenditures, whether $56 million or $70 million, might be claimed as TIF-reimbursable should be accounted for in the City’s accounting system and supported by the TIF-administration documents it should have received quarterly and annually from BTC. There should be no “TBDs” in the rows for BTC’s potentially TIF-reimbursable expenses incurred prior to Sept. 5, 2020.

One must ask, why are these pre Sept. 5, 2020 expenditures “to be determined” later, after the new Development Agreement documents have been approved by the City Council for signature? The City clearly, based on what’s on Exhibit O, has unknown additional financial responsibility for pre-Sept. 5th, 2020 work that TIF funds might be required to pay.

Before approving these new CityPlace documents, the City must deal with fixing it’s capital projects accounting procedures. TBD bookkeeping is scary bookkeeping. The City’s obligations for monitoring and accounting for TIF-reimbursable expenditures on the CityPlace development are explicitly explained in section 3 (c)(vii) of the 2017 Development Agreement as quoted here:

Section 3. Public Improvements; Additional Public Improvements; Construction of Public Improvements and Additional Public Improvements; Municipal Zoning.

3.(c)(vii)(A) vii. TIF Administration –Monthly and Annual Reporting.

A. To facilitate the City’s ability to promptly reimburse Owner for the budgeted, agreed upon costs of performing the Work at its conclusion in accordance with Section 4 of this Agreement, quarterly (each quarterly report to be organized by month)throughout the performance of the Work Owner shall provide the City with a spreadsheet that itemizes the amounts invoiced by each contractor and subcontractor together with invoice numbers, the dates of work covered by the invoices and brief descriptions of the work performed by each contractor and subcontractor, together with copies of:

1.requisitions submitted by contractors and subcontractors for performance of the Work that describe the Work performed;

2.evidence that the Work for which payment was requisitioned has been inspected and accepted under the inspection process outlined above; and

3.evidence of payment that corresponds to the amount requisitioned.

B. The City shall review the materials provided by Owner each month to confirm that the Work performed and the amount paid by Owner for the Work corresponds to the budgeted cost of the Work. If the City determines that the Work performed and the amount paid for the Work does not correspond to the budgeted cost of the Work, then it shall notify Owner of such determination within thirty (30) days after its receipt of Owner’s submission, and the Parties shall work together in good faith to resolve the matter to their mutual satisfaction.

C. To facilitate the City’s ability to promptly reimburse Owner for the budgeted, agreed upon costs of performing the Work at its conclusion in accordance with the Development Agreement, annually(meaning prior to June 30 of each year) throughout the performance of the Work Owner shall provide the City with annual reports with respect to items for which TIF funding is sought on forms provided by the City for such purposes, together with the back-up information and materials in the forms specified by the City during the pre-construction and construction meeting process outlined above which the City must receive in order to expend TIF funds in compliance with applicable laws, rules and regulations, which information and materials must comply in form and substance with the requirements and rules of the Vermont Economic Progress Council as they may be amended from time to time.

D. In accordance with the requirements established by the Vermont Economic Progress Council, the annual reports must include information regarding the number and types of jobs -both construction and new permanent jobs-created by the Work and by the completed Project using the North American Industry Classification System(NAICS)three digit code, organized by the number of jobs created per sector per fiscal year.

Third reason to vote “No”:

The history of three prior failed Development Agreements with BTC Mall Associates should have taught us a lesson . The City must take care to avoid following the same pathway to failure. There is a history of failed Development Agreements between BTC Mall Associates and Don Sinex that is about to be repeated with these documents.

1) Pre-Development Agreement dated May 12, 2016, available in the City’s 8/11/2016 TIF Reconciliation report at this link on the Agency of Commerce and Community Development’s website. (https://accd.vermont.gov/community-development/funding-incentives/tif/burlwf) Document link: https://accd.vermont.gov/sites/accdnew/files/documents/DED/VEPC/Tiff/BurlWaterfront/WaterfrontTIFDistrictReconcilationAmendment081116final.pdf

2) Development Agreement dated October 26, 2017 See documents of Oct 16, 2017 - Regular City Council Meeting, Deliberative Item 3.01 Resolution: Authorization To Resolve Litigation And Execute Amended And Restated Development Agreement With BTC Mall Associates (Councilor Paul) http://go.boarddocs.com/vt/burlingtonvt/Board.nsf/goto?open&id=AS3MR45C2F7A

3) Development Agreement is amended by “Letter Agreement “dated August 27, 2018, executed on September 7, 2018 to waive Original Development Agreement requirements that financial contract commitments exist for Public and Private parts of the project before permits issued for construction on foundation to begin. The “Side letter” in Deliberative item 6.04: Communication: Side Letter to Clarify Development Agreement for CityPlace Burlington.

Item 6.04 is here: http://go.boarddocs.com/vt/burlingtonvt/Board.nsf/goto?open&id=B3Y3KG073E74

C:\Users\PC\Documents\Burlington Town Center_CityPlace\2021_02_23_Special_CC_Meeting_CityPlace\2021_02_22_Five_reasons_new_CityPlace_development_agreements_should_not_be_approved.wpd

Fourth reason to vote “No”

The disorganized and confusingly identified documents provided to City Council for this consequential decision has resulted in obfuscation of the contract terms being approved.

The way the Development agreement documents are presented to City council use confusing names making it difficult for the Councilors and the public to understand what files contain relevant documents and what contract terms are being agreed to. This is the same thing that was done with the 2016 Development Agreement and the 2018 “side letter” amendment waiving the DA contract requirements for construction contracts to exist before permits for foundation work would be issued.

The 2/23/2021 documents are here: http://go.boarddocs.com/vt/burlingtonvt/Board.nsf/goto?open&id=BYDL7M553098

The list of documents is listed A) through F) below. Some are obviously named, for example:

A) “Amended and Restated Development Agreement” is in a file named: “Amended and Restated Development Agreement (Execution Version) (2).pdf”

B) “CITYPLACE ESCROW AGREEMENT” is in a file named: “Escrow Agreement (Execution Version).pdf” But the very important “LITIGATION RESOLUTION AGREEMENT” and the Exhibit C, MUTUAL RELEASE “ going with it are in a document named: “CEDO - Authorization to Resolve Litigation with BTC Mall Associates - Exhibits A-C.PDF”

C) LITIGATION RESOLUTION AGREEMENT

Exhibit A- STIPULATED MOTION FOR STAY OF LITIGATION

Exhibit B- STIPULATION FOR DISMISSAL WITH PREJUDICE

Exhibit C- MUTUAL RELEASE, giving blanket release from all conduct prior to new deals, “from the beginning of the world” (Ab Initio Mundi) these documents are in thefile named: “CEDO - Authorization to Resolve Litigation with BTC Mall Associates - Exhibits A-C.PDF”

D) Resolution for City Council to vote on:

AUTHORIZATION TO RESOLVE LITIGATION AND EXECUTE AMENDED AND RESTATED DEVELOPMENT AGREEMENT WITH BTC MALL ASSOCIATES in a file named: “CEDO - Authorization to Resolve Litigation and Execute Amended and Restated Development Agreement with BTC Mall Associates.final 1.pdf”

Exhibit D of the Amended and Restated Development Agreement is missing, and in its place is a notation: “Advanced Preliminary Budget [to be attached upon Release from Escrow] “ But, note that document E) appears to be a variant of this important document.

E) A projected TIF Budget estimate spreadsheet (in static .pdf format) is in a file named: “EA - O - Preliminary Budget 020821 - Final.pdf” This document shows the concerning column of potentially TIF-reimbursable expenses for BTC Mall Associates for expenses incurred prior to 9/5/2020 identified as “TBD” or “to be determined.” If these past expense records are in the City’s capital projects accounting system, why the “TBD”notation?

F) Undated letter of non-binding commitments from Don Sinex to Miro Weinberger which was posted to the City Council Feb. 16 BoardDocs City Council meeting documents on Feb. 16, after 8pm during the meeting as discussion began on Item 6.05 on the proposed replacement Development documents. Filename: “BTC Statement - Labor Issues[ Feb 16 2021 FINAL Executed copy.pdf” This letter has no binding effect whatsoever under the new Development Agreement.

Fifth reason to vote “No”:

The Litigation Resolution document includes an overly broad Mutual Release of liability for all claims that could be raised against BTC Mall Associates under any of the prior failed agreements which might be discovered by the City after the new versions of the development document are approved.

The proposed new agreements contain a blanket release of all prior claims the City might have against BTC Mall Associates for issues discovered at any time in the future which might relate to any of the prior failed Development Agreements “from the beginning of the world.” This sounds crazy but is an English translation for a Latin legal term “Ab Initio Mundi” making it more easily understood to mean every claim, period.

This is stated in Exhibit C, Litigation Resolution Agreement, found as the last item in document “CEDO - Authorization to Resolve Litigation with BTC Mall Associates - Exhibit A-C.PDF”

In Exhibit C- Mutual Release says:

“The Parties do hereby agree to release and forever discharge each other from actions, causes of action, suits, damages, judgments, executions, claims in law and equity which the Parties have or may have for any cause, reason or thing whatsoever, from the beginning of the world to the date of these presents, known or unknown, discoverable or undiscoverable, and including specifically those arising out of and regarding the Development Agreement dated October 26, 2017, as amended by Letter Agreement dated August 27, 2018 and fully executed on September 7, 2018 (as amended, the “Original Development Agreement”), and further including but not limited to any and all claims and counterclaims that were or could have been asserted by either the City or BTC against each other in the following actions:

City of Burlington v. BTC Mall Associates LLC, Docket No. 20-cv-00383 (Vt. Superior Court, Chittenden Unit), and BTC Mall Associates LLC v. City of Burlington, Docket No. 20-cv-00384 (Vt. Superior Court, Chittenden Unit).

For the purpose of this Mutual Release,the City shall be defined as the City of Burlington and its employees, officials, administrators, attorneys, and agents.

For the purpose of this Mutual Release, BTC shall be defined as BTC, RD Burlington Associates LLC, Devonwood City Place Investors, LLC, BDM Associates, LLC, Devonwood Investors, LLC, Devonwood II Investors, LLC, RSE Burlington, LLC, Brookfield Retail Properties, and each of their respective employees, agents, successors, assigns, current and former members, affiliates, managers, officers and directors. “

No comments:

Post a Comment